Financial planning isn’t complete without a budget. Your business needs a budget regardless of its size. No business is too small to have a budget. Budgeting involves planning and managing the allocation of your firm’s resources and controlling costs to achieve your stated financial goal.

Most of us think that a budget is just a small document that includes all the needs of the business and the allocated resources for them. Budgeting is beyond that. Budget is simple and, at the same time not simple. It is simple when you understand the techniques and approaches and can choose the most suitable one for your firm.

In this article, I will take you on a journey to exploring the different budget techniques, the approaches to budgets, the common pitfalls in budgeting you should avoid, and the difference between budgets and forecasts.

Types Of Budgeting Techniques

There are four major types of budgeting techniques. They are Incremental, Zero Based (ZBB), Activity Based, and value proposition.

1. Incremental Budgeting

If you are a small or medium business owner looking for a simple budget to develop, then the incremental budgeting technique is a good option. This is the simplest and most easy-to-understand budgeting technique. It entails adjusting (either adding or subtracting) the previous year’s budget to reflect the changes in the current year.

Incremental budgeting is ideal if you are in an industry where your cost drivers do not change frequently. However, the limitation of this budgeting technique is that it does not encourage critical thinking about resource allocation, and it may not be responsive to significant changes in the business environment.

There are external drivers of cost and performance you must incorporate, such as inflation, but this budgeting technique does not have maximum accommodation for it. Additionally, it can perpetuate inefficiencies. For instance, a manager may increase the firm’s budget by 10% every year, not considering or putting effort into finding how to cut costs. This is best for those in the industry with stable pricing.

2. Zero Based (ZBB) Budgeting

If you want to shake things up and keep your company’s finances tight, the zero-based budgeting technique is the best pick. If you suspect your manager is into unnecessary purchases, with a zero-based budgeting technique, you can keep track of your manager. The manager must account for each purchase and determine if it is essential to the company at that particular time.

This technique entails that each budget cycle starts from a “zero base,” and every function within the organization is analyzed for its needs and costs. Budgets are built around what is needed for the upcoming period regardless of previous budgets.

An advantage of this budgeting technique is that it helps eliminate redundant or obsolete activities and promotes justification for all expenses. The limitation of it is that it is that it is time-consuming, complex to implement, and requires significant effort and resources,

3. Activity Based Budgeting

Activity-based budgeting technique helps to develop budgets that provide a more accurate picture of costs and reduce the inclusion of non-value-added activities, which helps you to align resources with organizational goals.

Here, budgets are based on the expected activity levels and the resources required for these activities. The limitation is that it requires detailed activity analysis, which is time-consuming and expensive to carry out. Also, it is complex to implement.

4. Value Proposition Budgeting

This value proposition budgeting technique is the budget type that allows you to include only things of value in your budget. It is an approach that focuses on ensuring that every budget item delivers value to the organization, its customers, and stakeholders. This technique aims to help you to align spending with the organization’s strategic goals.

The setback of this budgeting technique is that it requires you to carry out detailed analysis and understanding of value drivers, which is complex and time-consuming. For expenditures with non-financial benefits, it will be challenging to quantify the value contribution.

Approaches To Budgeting- Top-Down & Bottom-Up Approach

There are two major approaches to budgeting. They are top-down and bottom-up approaches. Each of these approaches has its peculiarities, advantages, and disadvantages. None of these approaches are inherently better than the other. To choose the best approach for your company, you have to carefully analyze your company’s dynamics, size, and nature to know which will be more suitable. Let’s look at what they both entail:

1. Top-Down Approach

As the name implies, senior management sets the overall budget goals and allocates resources to different departments or units. It follows from the top of the hierarchy to the bottom. Departmental heads receive the budget goals and resources from above and prepare their budgets based on these allocations. Here, the senior management dictates and sets the tone for the budgeting.

- Advantages: Helps to ensure budget alignment with organizational goals and gives the management central control over resources. Also, it is easy to prepare and implement.

- Disadvantages: The lack of input from lower levels can lead to the formation of unrealistic or unmotivated departmental budgets. Thus, causing a disconnect between strategy and operational realities.

2. Bottom-Up Approach

In the bottom-up approach, the budgeting starts at the departmental or unit level. Each department prepares its budget based on its needs and goals and submits it to the senior management. The senior management aggregates them all to form the overall organizational budget.

- Advantages: Helps in forming more accurate and realistic budgets and promotes motivation and accountability among the employees.

- Disadvantages: It is time-consuming and might require extensive coordination and alignment, which can be tasking.

Common Pit-Falls In Budgeting

Here are the top five common mistakes most people make in budgeting that you should avoid:

- Over-Optimism: This entails overestimating revenues and underestimating expenses, thereby leading to the formation of unrealistic budgets. You might have seen a forecast that the cost of things that comprise your expenses will drop, and you are being hopeful. I understand that, but at the same time, be realistic. In the same light, be cautious about projecting an increase in your company’s revenue and including it in the budget.

- Lack of Flexibility: It is good for your budget to be a little bit tight, but not too rigid to accommodate unexpected changes or opportunities.

- Inadequate Communication: Poor communication between departments and management disrupts effective information collation necessary for developing an informed budget.

- Failure to Monitor: Not regularly reviewing and adjusting the budget is a mistake you should avoid, as it can create room for inefficiencies, overspending, or missed opportunities.

- Ignoring External Factors: Failing to consider external market factors, and economic and competitive conditions can make budgets ineffective.

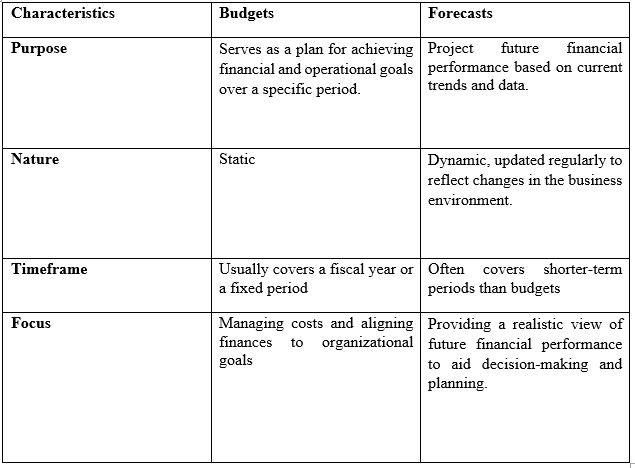

Differences Between Budgets & Forecasts

Conclusion

There are no inherent good or bad budgeting techniques or approaches. It all depends on your business type and nature. Understand the dynamics of your business, and carefully choose the best budgeting technique and approach that can be suitable. If you own a medium to large firm, and you think it will be tasking for you, you can get a consultant to help you.