You will have issues implementing your financial plan if your financial resources are not well allocated. As much as you dedicate time to planning a highly flexible and efficient plan, you have to ensure that the available resources are allocated optimally.

These financial resources are limited; if they are not distributed efficiently, prioritized tasks and projects might not be carried out because of shortage or lack of funds. This will significantly affect your business.

There are key business priorities you should focus on when allocating resources. Other crucial factors include, assessing the right investments based on the risk and returns on investment (ROI) and managing the timing and volume of funds allocated to keep the business thriving. By focusing on these elements, you can make informed decisions that drive growth, efficiency, and long-term success.

Here in this article, you will get to understand them and know how to practice them to ensure your business’s financial resources get allocated optimally.

Optimally Allocate Financial Resources: What It Entails

Optimal financial resource allocation entails directing funds toward initiatives that align with your strategic goals, assessing risks and returns, and managing investments to ensure both profitability and liquidity.

Optimally allocating your financial resources starts with identifying your strategic objectives and the non-negotiable success factors necessary for achieving them, assessing investment opportunities based on potential returns and acceptable risk levels, and managing the timing and volume of financial investments to balance profitability with liquidity.

Non-Negotiable Success Factors for Strategic Priorities of the Business

The first thing to do when identifying the non-negotiable success factors is to state your business strategic priorities. Strategic priorities are the key goals your business aims to achieve over the short-term and long-term. These might include:

- Market Expansion: Entering new markets or increasing market share.

- Product Innovation: Developing new products or improving existing ones.

- Operational Efficiency: Streamlining operations to reduce costs or improve quality.

- Customer Satisfaction: Enhancing customer service and experience.

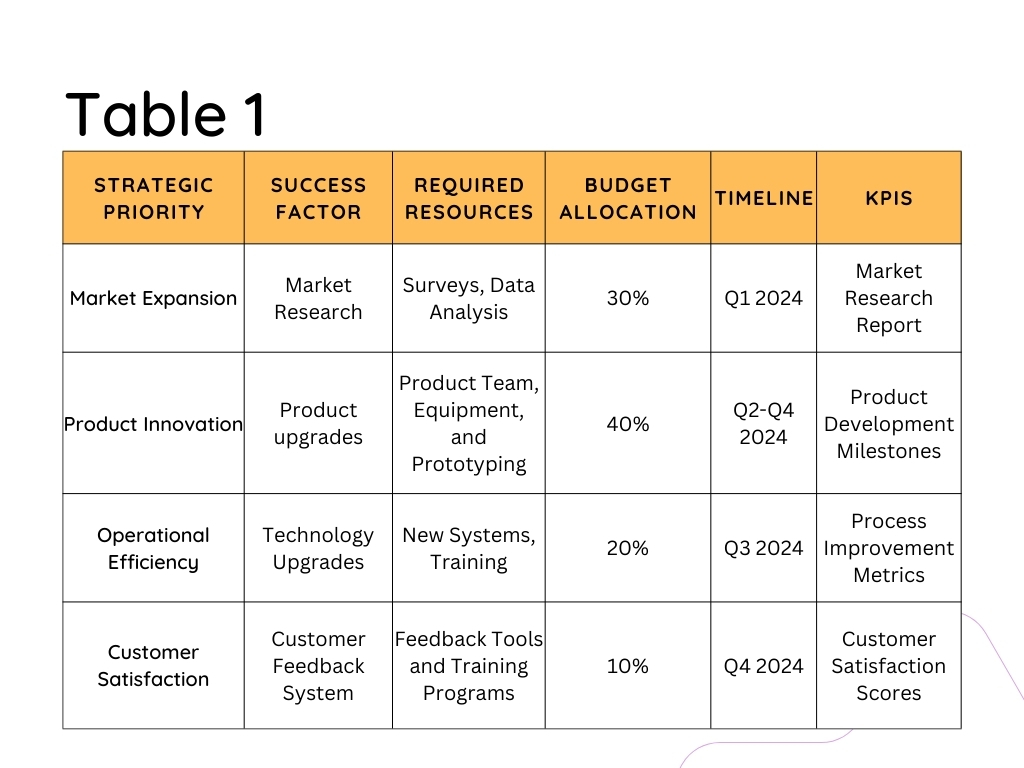

After stating the strategic priorities, the next step is to identify the critical elements that are needed and are indispensable for achieving each strategic priority. These factors should be specific, measurable, and actionable.

Examples include:

- Market Expansion: Effective market research

- Product Innovation: Product upgrade

- Operational Efficiency: Technology upgrade

- Customer Satisfaction: Building a responsive customer support team.

The next step is to allocate the financial resources to support each of the non-negotiable success factors. This means prioritizing budgets for these elements. For example:

- Market Research: Funds for surveys, data collection, and market analysis.

- Product upgrade: Budget for research teams, materials, and development processes.

- Technology Upgrades: Investment in new technologies and systems.

- Customer Support: Resources for training, tools, and support systems.

Next, create a detailed budget that reflects the importance of each success factor. Allocate funds to the highest-priority areas first, before the less priority ones. For example:

- Market Research: 30%

- Product upgrade: 40%

- Technology Upgrades: 20%

- Customer Support: 10%

Allocate Based on Returns on Investment (ROI), Subject to Acceptable Risk Level

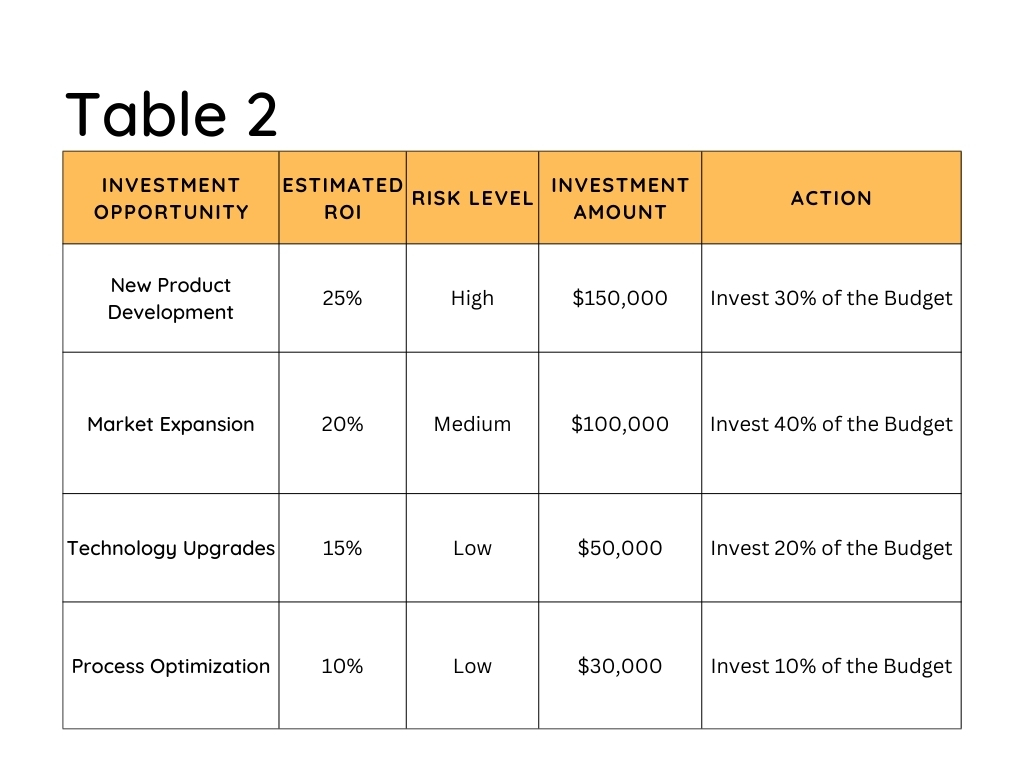

Apart from identifying the non-negotiable success factors, the next strategy for optimally allocating financial resources is evaluating potential investments based on their expected ROI and associated risks. By calculating ROI, assessing risks, and balancing high-risk and low-risk investments, you develop a risk management plan that helps you make strategic decisions that maximize returns while managing potential downsides.

ROI is the index used to measure the profitability of an investment and you can calculate it using this formula. Net Profit x 100%

Investment Cost

To assess the risk of an investment, you need to consider factors like market volatility, operational risks, and financial stability. The risk can either be high or low. Investments with higher risk usually have higher rewards while those with lower risk offer more stable but small returns. However, the best practice is to allocate resources to opportunities with the best combination of high returns and acceptable risk levels.

Use a risk management framework to make informed decisions. For instance:

Modify Timing and Volume of Fund Allocation to Optimize Profitability and Liquidity

Timing is crucial; deploying funds at the right moment can help you capitalize on market opportunities, reduce costs, and increase returns. You don’t just jump into allocating money for investments or upgrade projects, without first determining if the timing is right. Optimize the timing of your investments based on market conditions, project timelines, and financial forecasts. Invest when conditions are favorable and defer investments if the timing is not ideal.

For instance, investing in technology upgrades during a downturn might be cheaper and prepare the business to leverage the subsequent recovery. Conversely, delaying investments until market conditions improve can prevent overexposure to risk during volatile periods. Therefore, aligning investment timing with market conditions, business cycles, and strategic milestones is key to maximizing profitability.

In addition to timing, adjusting the volume of fund allocation is essential for maintaining liquidity while pursuing profitability. Do not invest so much that your business lacks adequate liquidity for efficient functioning. Overcommitting funds to long-term investments can strain cash flow and limit the business’s ability to respond to immediate needs or opportunities. So, you have to ensure everything is balanced.

A balanced approach involves prioritizing success factors and investments based on performance and current financial health. For instance, start with smaller, pilot investments in new projects and gradually increase funding as they prove successful. This iterative funding model helps manage risk and preserves liquidity.

Review each investment meticulously and adjust the volume of the allocated funds if needs arise to ensure the business has enough cash flow to sustain operations, meet unexpected expenses, and take advantage of emerging opportunities without compromising its financial stability. This might be a bit complex, but you can pull it up with the right team and knowledge.

Final Words

Regardless of your great financial plan, focusing on optimally allocating your financial resources is equally important. Without efficient allocation, your prioritized tasks and projects may falter due to a lack of funds.

If you need help in implementing your financial plan despite having a well-crafted strategy, contact Mac Adebowale Professional Service at emails@macadebowale.com now, and let’s work together!